Langnostik is a parsing platform for transforming jargon-heavy documents into clear, structured language for humans and AI.

Langnostik reveals what experts see by enriching documents with deterministic parsing — instantly and without training, hallucination, or guesswork.

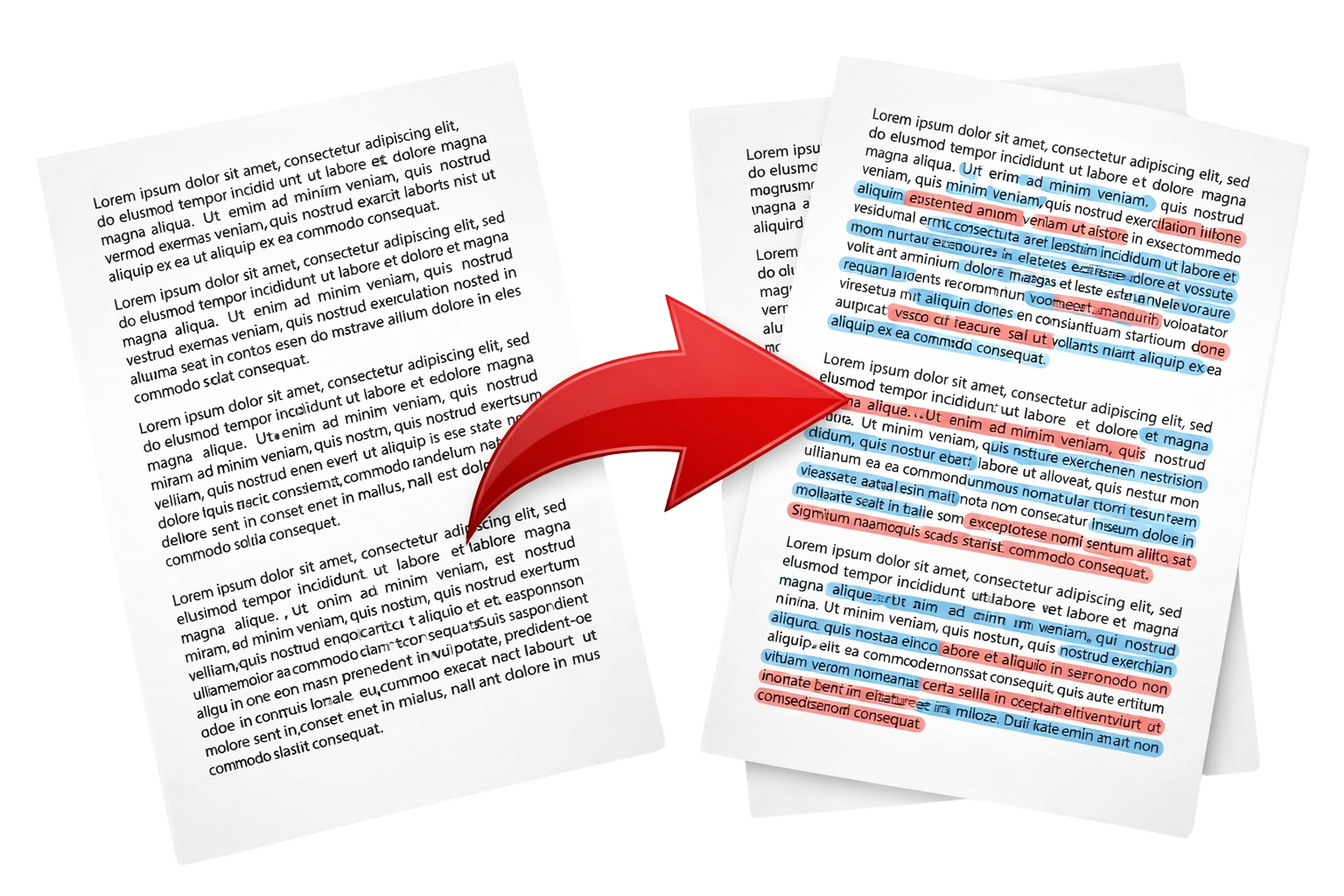

Note how complex wording becomes clearer when enriched

Notice what changes, and how it adds meaning.

LIP parses domain-specific phrasing, acronyms, and compound terms into a normalized, structured form. Think of it as revealing the “full shape” of the language you’re already using.

Standard Input

Enriched Output

Standard Input

Enriched Output

Standard Input

Enriched Output

Standard Input

Enriched Output

Standard Input

Enriched Output

Standard Input

Enriched Output

Now that you've seen it, here’s what’s happening

When subject matter experts read technical or specialized writing, much of the structure is implicit: shorthand, acronyms, domain-specific phrasing, and conventions that don’t need to be spelled out.

Other readers — and AI systems — don’t have access to that implicit structure.

Language-Independent Parsing (LIP) helps make that structure explicit, not by interpreting meaning, but by applying deterministic, expert-defined rules. Domain specialists define and continuously enhance libraries that normalize how terms, phrases, and compound expressions are used in their field — including conventions, common typos, variants, and context-dependent constructions.

The examples above are intentionally simple. In practice, LIP resolves overlapping phrases, stabilizes sub-phrases before higher-order expressions, and normalizes text through cascading rules — producing clearer, readable output while preserving the original wording exactly as written.

It’s rule-driven. It’s predictable. And it behaves the same way every time you run it.

Garbage in → hallucinations out

Ambiguous or overloaded text creates confusion — for people and for AI models.

LIP gives both a clearer starting point. And once the input is cleaner, everything downstream becomes easier

See how LIP libraries work

When you're ready, go deeper here.